Taxation. Objectives of This Lecture Discuss the economics and nature of taxes. An unbiased approach. Assist students to see that: –Taxation is a complicated. - ppt download

The Role of Government Can you think of any government services in our economy? Brainstorm and make a list! - ppt download

Benefit principle of taxation,benefit received, cost of services, ability to pay principle, - YouTube

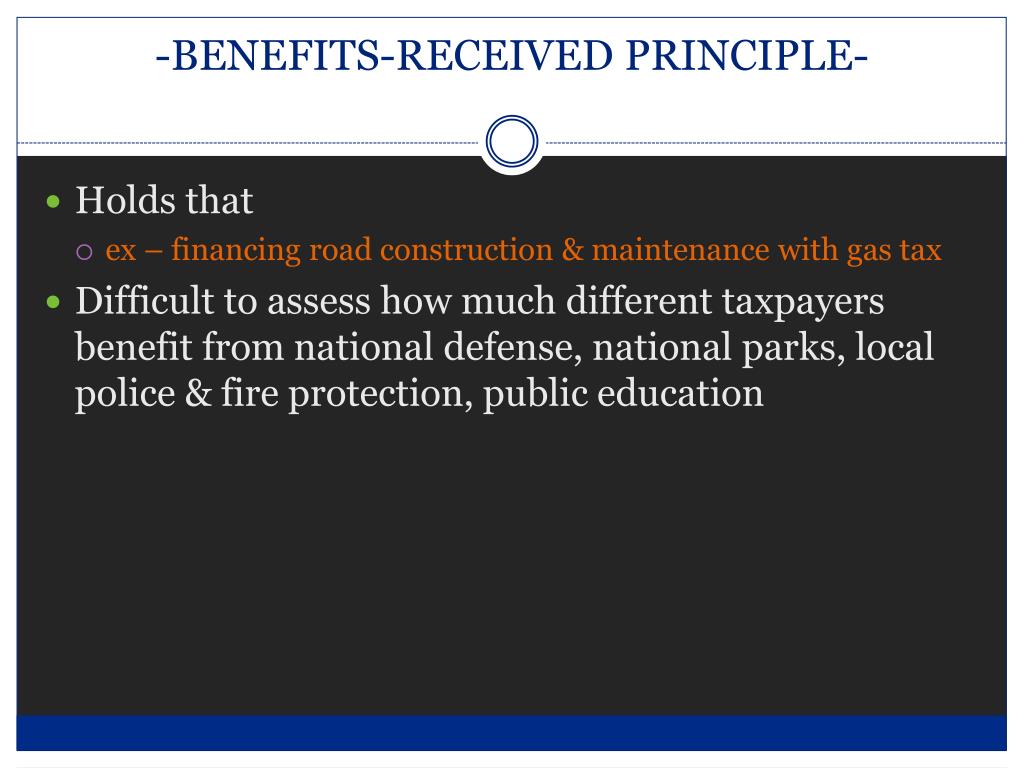

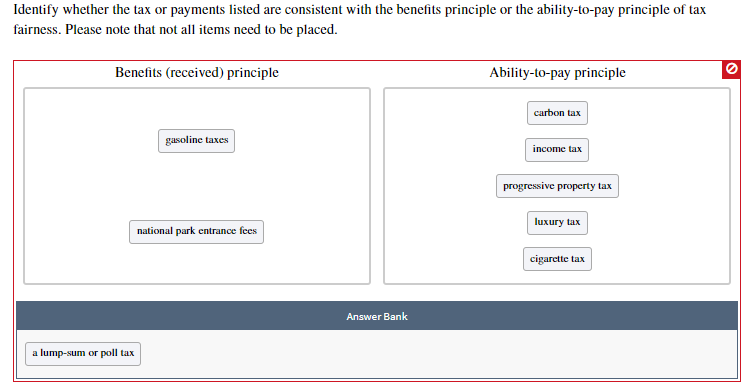

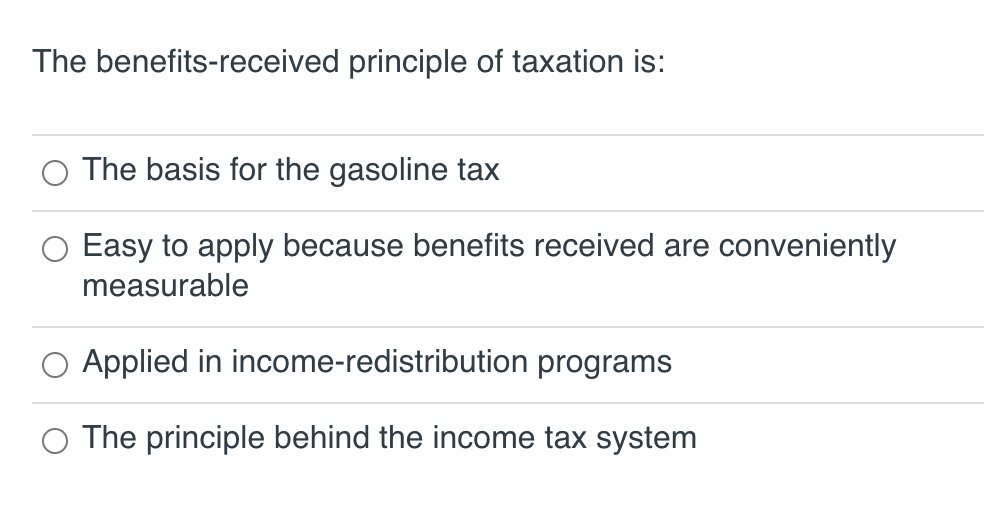

SOLVED:Distinguish between the benefits-received and the ability-to-pay principles of taxation. Which philosophy is more evident in our present tax structure? Justify your answer. To which principle of taxation do you subscribe? Why?

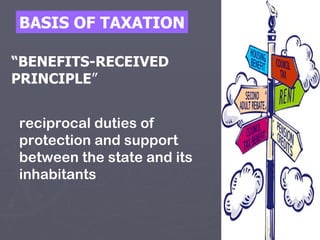

Solved Questions Principles of Macroeconomics - Quiz 1 | ECONOM 1015 | Quizzes Introduction to Macroeconomics | Docsity

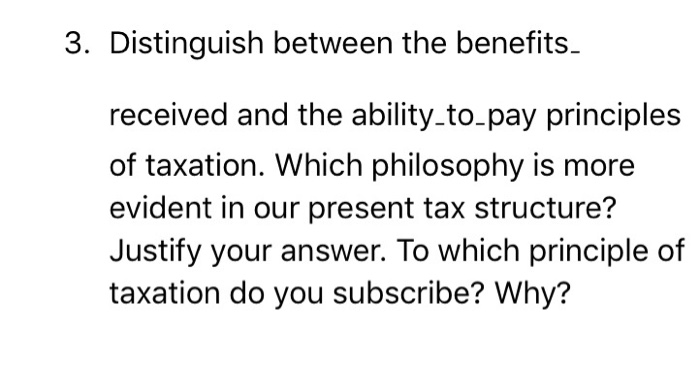

Taxes and GovernmentSpending What is a tax? A required payment to a local, state or national government What is revenue? Income received by a government. - ppt download

:max_bytes(150000):strip_icc()/Term-Definitions_Opportunity-cost2-614cfb37567040879073c5ed1d03b25c.png)

:max_bytes(150000):strip_icc()/WhatIstheBenefitsReceivedRuleNov.242021-e3678e0fe6254e488eddb15c02ee1616.jpg)

:max_bytes(150000):strip_icc()/MarginalBenefit-73b16b9782694680a1b7a08a721d6c1f.jpg)